Archive

To buyback or not to buyback, that is the question

Financial engineering. Sounds bad, doesn’t it. Not as bad as “financial weapons of mass destruction,” but bad. Financial engineering is the term now used to describe a set of activist strategies, including share buybacks, dividends, spinoffs and mergers. According to Activist Insight, more than 600 activist investments since 2010 (more than a quarter of all activism) qualify as financial engineering.

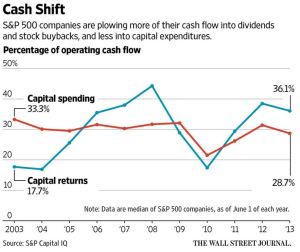

The effect seems profound. S&P Capital IQ calculates that companies in the S&P 500 now spend 36% of operating cash flow on dividends – significantly more than the 29% of operating cash flow committed to capital expenditures.

Some economists fear that reducing capital spending results in lower growth and fewer jobs. A recent paper from Harvard advocates banning share buybacks. The Economist notes that US corporations spent $500 billion on buybacks in the 12 months ending in September 2014 and calls buybacks “corporate cocaine.”

Much of the criticism levied against financial engineering and buybacks, in particular, treads familiar ground: activists are forcing corporations to make decisions that sacrifice long term growth for the sake of near term reward.

A new paper from Proxy Mosaic examines activist campaigns that could be termed financial engineering and suggests critiques based on short termism are probably misplaced. According to Proxy Mosaic, total returns to shareholders increase over time and on average activist campaigns that result in buybacks, spinoffs, etc. generate more than 25% returns. Looking at individual strategies, spinoffs generate the highest returns (about 50%) followed by buybacks at nearly 30%. The caveat is that activists’ financially-driven strategies do not typically beat the market. Buybacks, for example, trail the S&P 500 performance by 3%.

Proxy Mosaic concludes that:

- The type of financial engineering matters (spinoff strategies typically generate strong returns, while acquisitions are dilutive)

- Financial engineering transactions “may actually have moderate longer-term benefits to shareholders.”

- “Shareholders have legitimate reasons to be wary of activist that advocate for financial engineering transactions…[while] financial engineering has been a valid and productive strategy on an absolute basis, it is not clear that shareholders are actually better off after the activist intervention.”

We should expect that financial engineering, particularly stock buybacks and special dividends, will be the focus of growing analysis, attention and debate. Corporate governance experts will have their say. Boards might become more hesitant to approve share buybacks. Ultimately, it might become easier for corporations to resist activists pursuing financial engineering strategies.

For activists, even in the near term, the bar is rising when it comes to pressuring companies for share buybacks. Activists are going to have to be even more persuasive among investors and the media to get support for campaigns in the financial engineering category. Activists will have to become more selective, more data driven (when making their case) and, perhaps, more prepared for long campaigns, assuming that companies have stronger ground to resist calls for share buybacks.

Those activists who are best at picking their spots, communicating effectively and bucking the financial engineering stigma, will separate themselves from other funds and enjoy the benefits that come with being perceived as leaders within the activist sector.