Archive

Hedge fund vs index fund

Passively managed funds are under attack again. Last summer Carl Icahn famously blasted fixed income ETFs and this month, Bill Ackman devotes one third of Pershing Square’s annual letter to investors to criticizing index funds.

under attack again. Last summer Carl Icahn famously blasted fixed income ETFs and this month, Bill Ackman devotes one third of Pershing Square’s annual letter to investors to criticizing index funds.

To start, the letter suggests that as asset flow to index funds accelerates it creates momentum in the indexes they seek to represent which raises the bar for hedge funds benchmarking to those indexes. Violins. Returns are down among activist managers and when looking at individual stocks, excess gain from activist campaigns dropped significantly from 2012 to 2015. S&P’s US Activist Interest Index is down 31% in the last year.

His primary claim is that index funds have no incentive to pursue good governance at companies within their portfolio and cannot have the bandwidth to make intelligent proxy decisions. “Index funds managers are not compensated for investment performance, but rather for growing assets under management. They are principally judged on the basis of how closely they track index performance and how low their fees are. While index fund managers are, of course, fiduciaries for their investors, the job of overseeing the governance of the tens of thousands of companies for which they are major shareholders is an incredibly burdensome and almost impossible job. Imagine having to read 20,000 proxy statements which arrive in February and March and having to vote them by May when you have not likely read the annual report, spent little time, if any, with the management or board members, and haven’t been schooled in the industries which comprise the index.”

He cites the example of Dupont when last year index managers who owned 18% of the stock voted against board members proposed by Trian Capital Management. He also says that the lack of index fund support for Pershing Square’s teaming with Valeant to buy Allergan shows how those firms “did not take this issue [corporate governance] seriously.”

This is an extremely thin argument, especially the case involving Valeant in which the legality of Pershing Square’s actions were broadly questioned. In reality, index fund companies are getting much more involved in governance and are engaged with corporations and their boards. Evidence is everywhere. BlackRock, State Street and Vanguard are members of the Shareholder-Director Exchange, a group formed to enhance shareholder-director engagement.

Recently, Doug Braunstein of Hudson Executive Capital called Michelle Edkins, BlackRock’s head of corporate governance, the most powerful person in corporate America because of BlackRock’s ability to influence corporate boardrooms.

The assertion that index managers are not motivated by performance is wrong. If indexes keep going up, assets will keep flowing in. The index manager is constrained in terms of allocation of the portfolio and cannot sell an underperformer. This creates a powerful incentive to ensure that index constituents perform. Governance is the steering wheel whereby passive investors can influence performance. This makes them natural allies of activists, not disinterested bystanders as Ackman might have us believe.

Larry Fink CEO of BlackRock which manages $2.7 trillion in index funds wrote an open letter to 500 CEOs encouraging a new focus on clear long-term vision, strategic direction and credible metrics against which to assess performance. “At BlackRock we want companies to be more transparent about their long-term strategies so that we can measure them over a long cycle. If a company gives us a five-year or a 10-year business plan, we can measure throughout the period to see if it’s living up to the plan. Is it investing the way it said it would? Is it repaying capital to shareholders?” he asks.

To me this is about getting leverage on corporations and holding them accountable.

As index fund managers ramp up their focus on governance, there is broad opportunity for activists to tap into that growing sector for support because to a large extent, their interests are aligned. What activists have to worry about is the possibility that index funds diverge from hedge funds and forge their own path in advancing the governance principles they perceive as enhancing long term corporate performance. Braunstein predicts that in five years every public company will have an investor member on its board.

The SDX is one example of how index fund managers are pursuing a governance agenda independent of activists. Last month another step in going it alone was taken when it was announced that BlackRock is among the founders of Focusing Capital on the Long Term, a group of large global investors which also founded the S&P Long-Term Value Creation Global Index.

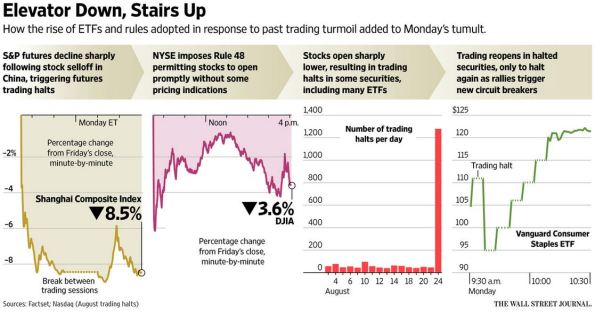

Carl Icahn is right….again

The “debate” between Carl Icahn and Larry Fink at the Delivering  Alpha conference last July stirred up the media, but was not not the best theatre, in part because Carl Icahn hijacked the discussion with a rambling, disjointed critique of bond ETFs. You can view the exchange here.

Alpha conference last July stirred up the media, but was not not the best theatre, in part because Carl Icahn hijacked the discussion with a rambling, disjointed critique of bond ETFs. You can view the exchange here.

What a difference a couple of weeks make. The China-induced market crash not only exposed liquidity and pricing challenges in ETFs presaged by Icahn, but also that the risk extends to vanilla equity ETFs.

The Wall Street Journal reports about price drops in ETFs that exceeded the declines in prices of the underlying holdings and halts in trading among large ETFs, resulting in “outsize losses for investors who entered sell orders at the depth of the panic.” In a similar examination of a disconnect between investor expectations and market function, Reuters writes that certain mutual funds focused on syndicated loans are opting to hold more cash to prepare for redemptions in a market where liquidity and trade settlement risk are well known to insiders.

So it turns out that Mr. Icahn was right (again). Icahn is unique among activists because he addresses the marketplace issues that affect all investors. Corporate governance is a mainstay of the Icahn platform and at Delivering Alpha, he shows us that market structure, product suitability and risk disclosures are equally important. Hedge funds need to join the debate on these issues.

At a time when the reputation of hedge funds, especially activists, is at a tipping point, managers should be increasingly vocal on topics that trigger automatic support from the media, regulators and the public: fair play in the markets, transparency and misrepresented risks, and even HFT.

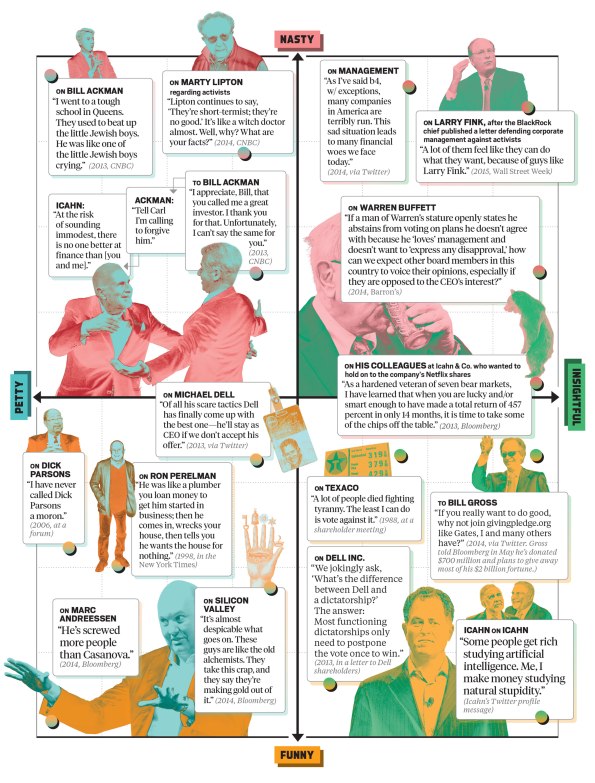

A picture of Carl Icahn

Bloomberg Markets Magazine features this infographic on the history of Carl Icahn. A picture is definitely worth a thousand words. Wouldn’t it be great if he did his own infographic on his view of the world?

Activists bash old media, but don’t get new media

Wall Street Week is back. No, not on PBS, its home for 35 years,  but streaming online courtesy of Anthony Scaramucci of SkyBridge Capital. SkyBridge has billions invested in activist hedge funds and activists feature prominently in the early episodes of Wall Street Week. Jeffrey Smith (Starboard Value), Carl Icahn and Barry Rosenstein (Jana Partners) are recent guests.

but streaming online courtesy of Anthony Scaramucci of SkyBridge Capital. SkyBridge has billions invested in activist hedge funds and activists feature prominently in the early episodes of Wall Street Week. Jeffrey Smith (Starboard Value), Carl Icahn and Barry Rosenstein (Jana Partners) are recent guests.

Online TV is the newest channel to be taste tested by the hedge fund industry in its quest for alternative ways to get its message to investors. In general, blogs, video, Twitter and LinkedIn are underused media for hedge funds, despite the fact that hedge funds are critical of the state of traditional media. According to the Wall Street Journal, at the Ira Sohn conference, Barry Rosenstein of Jana Partners lamented “the media covers activist campaigns like political campaigns, focusing on the horserace rather than on the substance of their suggestions.”

That’s the reason the industry, particularly activists, need to pay attention to new media. It provides the manager the ability to control the message, communicate complicated ideas (concepts that do not lend themselves to short form journalism and sound bites) and create a permanent searchable record that can be accessed by anyone, including journalists, researching a company or idea.

The benefits of new media are not lost on activists. Carl Icahn is the activist most committed to new media. Years ago, he hired a Reuters reporter to be his blogger in residence. Recently, he relaunched his blog under the moniker Shareholders’ Square Table. @Carl_C_Icahn is also active on Twitter. Pershing Square is famous for its live town halls.

Success in digital media (or social media, or new media or whatever you want to call it) hinges on engaging with the market on a topic that has lasting importance/interest and being consistent about discussing it across multiple channels. No hedge fund manager is doing this effectively.

Icahn has the right idea, but his commitment to the corporate governance mantle targeted by Shareholders Square Table comes in fits and starts. In November 2008, Pershing Square told investors it was “important for the hedge fund industry to come out of the shadows and defend the importance of our work.” Less than a year later, Pershing Square reversed course, telling investors “we will do our best to fade into the sunset as far as the media is concerned.” Most other activists focus only on the tactical requirements of their campaigns and pop in and out of the public sphere, accordingly.

Is it any wonder, then, that so many journalists and other influencers are unconvinced that activist hedge funds are a productive, corrective force in the capital markets.

A year ago Anthony Scaramucci suggested that an activist can usurp Warren Buffet as the preeminent voice in the market for good governance and how to create value for shareholders. That opportunity still exists and, with Wall Street Week, Scaramucci gives activists yet another platform with which to convince people.

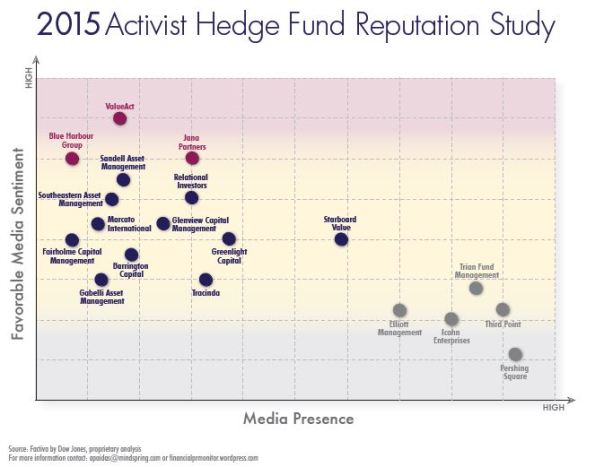

Activist hedge fund reputation sinks as media coverage soars

The more media coverage an activist hedge fund gets, the more negative it becomes. That’s the key finding in my study of activists in the press.

Value Act, Jana Partners and Blue Harbour Group are the funds which score highest in terms of positive media sentiment. Their high scores for reputation are tempered, however, by the low volume of media coverage they receive. That said, these funds are well regarded in the press for their success in using constructive and typically non-confrontational approaches to engaging with management and boards.

The biggest names in the business (Pershing Square, Third Point, Elliott Management, Icahn and Trian) are on the other end of the spectrum. They receive enormous media attention but the sentiment in that coverage is much more negative. With greater attention comes greater scrutiny and the media are compelled to come up with new story lines about these funds. Tactics are questioned, managers’ personalities become news, wealth becomes a focus. Even when they score a victory the media coverage will often include reference to a past failure. The bigger the target or the bigger the campaign the greater the risk for negative publicity. Elliott’s fight with the Argentine government, Pershing Square’s campaigns on Allergan and Herbalife and Trian’s fight with Dupont have each been damaging to the managers’ reputation.

In studying the media coverage activist managers’ preference for letting their campaign records do the talking become clear. Most managers do not directly engage with the press, but use letters to shareholders and CEOs/boards as proxies for media relations. Of course some managers do make the rounds on TV, do live events with reporters in attendance and even sit with journalists for in depth interviews. But for the most part, the activist industry wants their record to define them. This is a mistake and the activist scorecard is insufficient to build a consistent, positive reputation. Look at Starboard Value, a fund that has become more active in recent years and received more press, as a result. Their record in terms of wins and losses has been highly positive, yet, the sentiment in the media is more or less neutral.

That is because reputation has to be about more than wins and losses. The previous post in this blog focused on whether activism is good for our financial system. That is the big question and the fact that activists have been winning a lot more than they have been losing doesn’t provide the answer.

The research shows that certain funds would probably benefit from greater media exposure and that the name brand funds would benefit from picking their public battles more carefully and calibrating campaigns based on the associated reputational risk.

From the research one can also conclude that if the activists which get the largest share of voice in the media are viewed negatively, it creates a risk for the entire sector. The case still has to be made for activism: how activists improve corporate governance, accelerate corporate performance and advance the interests of other investors. Until that happens, the activist sector itself faces the risk that the media, the market and even regulators will decide that they are part of the problem rather than part of the solution.

Hedge fund headlines in brief

Line blurs between long-only managers and activists. The battle for the hearts and proxy votes of pension funds that was the subject of our last posting is now examined by The New York Times and this account suggests activists are gaining the upper hand and that certain pension funds and activists are “constantly discussing a variety of companies.” Performance of the activist segment is one driver for the increase in engagement, but the story says “activists may have also done themselves a favor by cleaning up their image.” As we wrote in our previous post, the open question is which activists will create the brand and reputation that will become the trusted partner for pension funds. The reward for getting this right is enormous. The Times cites ValueAct and its thesis on Microsoft and explains “though ValueAct had bought less than 1 percent of Microsoft’s stock, the company granted the fund a board seat, recognizing that the hedge fund was speaking for other investors, too.”

Hedge funds turn up the volume with new media. Balyasny Asset Management generated buzz with its print ad campaign, the likes of which are permissible under the JOBS Act. The JOBS Act which eases the ban on general solicitation has emboldened hedge funds to also post commentary videos to their Web sites and to have managers appear more frequently on TV. Take that lawyers! In other new media news, Greenlight Capital is suing to find the identity of an anonymous blogger who supposedly disclosed a position taken by the fund, Carl Icahn expands his electronic media presence to Facebook, and Glaucus Research adapts a popular Hitler video on YouTube to jab Ocwen Financial, which the fund accuses of financial impropriety.

The long haul for the Herbalife short. Almost a year into it, Pershing Square is keeping the pressure on Herbalife. The newest lever pulled by the fund? Lawmakers. A detailed account of the multifaceted campaign organized by Pershing Square examines lobbying, grassroots organizing, letter writing and a focus on Latinos that are the newest tactics employed by the fund and its consultants.

Hedge fund year in review

No better time than the present (even if it’s already March) for a review of the year that was in the world of hedge fund media. Three story lines were recurring and continue to be extremely relevant this year: activist funds taking on “big game” in the form of global corporations; whether or not “real money” asset managers will stay on the sidelines or join forces with activists; and, the ongoing saga involving Herbalife.

Trend #1: 2013 was the year that activist funds upped the ante and consistently turned up the heat on global corporations. Hess, Apple, Sony, and Pepsi were/are targets of a who’s who of activist investing: Elliott Management, Greenlight Capital, Third Point, and Trian, respectively. Elliott won board seats at Hess, Apple started a share buyback plan and increased its dividend, Third Point has lost money on Sony buy continues to call for the company to make “difficult decisions” and spin off parts of the company, and Trian is still arguing for Pepsi to spin off its beverage business and bulk up in snack foods. Not a bad track record, given size of these corporations.

Expect more of this big game hunting by activist funds. Indeed, investment banks and the largest law firms are increasingly advising corporate clients on how to cope with, and better yet, avert activist attention. It remains to be seen how corporations can begin to think like an activist (in attempts to avoid being targeted). If they do, it should result in higher profits, sharper strategy and better governance. According to a Conference Board Report, as of September 2013, hedge funds were “somewhat victorious” in 19 of 24 proxy contests initiated to that point last year, suggesting that shareholders are also starting to think like an activist.

Trend #2: Pension funds and other traditional asset managers are beginning to engage more with corporate boards and activists. Called “sleeping giants” by this blog, pension funds are where the muscle is. The enduring question is do they have the stomach to advocate forcefully for change aimed and boosting share prices. Calpers and Calstrs have long focused on good corporate governance and evidence is mounting that other pension funds are ready to be more proactive with corporate boards. Nell Minow, the co-founder of the governance advisory firm GMI Ratings, says there has been “a shift in tactics” among big pension funds “from shareholder proposals to engagement and director replacement.”

The newly-formed Shareholder-Director Exchange is a group comprised of corporations and asset mangers that developed a “protocol” for institutional investors and board members to follow when either side wants to talk to the other. While the SDX operates within the traditional realm of corporation-shareholder relations, pension funds want more engagement and presumably more accountability from boards. Activists are not part of the SDX, but if I were an activist, I would view this as promising for my strategies (more on this next time).

Trend #3: What is going on with Herbalife? Herbalife was the biggest headline getter in 2013 and it produced an almost a non-stop series of tabloid quality story lines that included the likes of Pershing Square, George Soros, Third Point, Perry Capital and others. The saga continues and now the government is investigating Herbalife (chalk one up for Pershing Square). Net net, no one really knows what’s the deal with Herbalife. The longs won out in 2013, but it’s a new year.

Hedge fund profiles: The medium is the message

In his 1964 study of media theory, Understanding Media, Marshall McLuhan wrote “the medium is the message” to suggest that the way by which a thought is conveyed is more important that the actual message itself. In thinking about a flurry of recent profiles of hedge fund profiles in the press, all you need to know is the title (medium) to know what is being said about the hedge fund (message).

In his 1964 study of media theory, Understanding Media, Marshall McLuhan wrote “the medium is the message” to suggest that the way by which a thought is conveyed is more important that the actual message itself. In thinking about a flurry of recent profiles of hedge fund profiles in the press, all you need to know is the title (medium) to know what is being said about the hedge fund (message).

With a medium like Bloomberg BusinessWeek or Institutional Investor’s Alpha, you know what you are going to get: in depth analysis of a manager, what makes his/her strategy successful and some facts about how the fund handles risk management or other critical operating procedures. Recent profiles of David Einhorn/Greenlight Capital and Starboard Value follow a the traditional fund profile template. Two other, even more exemplary profiles, written last year were recognized with the Hedge Fund Article of the Year Award.

At the same time, with a medium like Vanity Fair, you also know what you are going to get: a personality-driven puff piece that is light on investment process and heavy on the cliches that all too often define successful hedge fund managers. This didn’t deter Pershing Square’s William Ackman from participating in a feature in the April issue focused on his well-documented short position in Herbalife. The result is an uneven account of Pershing’s investment that, by outlining fallings out between Ackman and other respected investors, like Daniel Loeb and David Einhorn, promotes the idea that Ackman has a “Superman complex” and “an uncanny knack for….pissing people off.”

If we believe that the medium is the message it should not be a surprise that Vanity Fair emphasized conflict, ego, drama and wealth (of course the writer could not refrain from weaving Ackman’s private jet into the story) over the business of running a multi-billion dollar hedge fund. So why answer the phone when a celebrity magazine calls? I don’t know. The outcome cannot be valuable to a hedge fund’s core audience of institutional investors. Maybe Pershing Square wants to reach a different audience — high-net-worth investors, for example.

Ackman has been playing the media game for a long time and understands the risks and rewards, but anyone else should hang up if Vanity Fair happens to call.

Activists can win their battles but lose out in war for reputation

The stock market is at new highs, but, ironically,  shareholder activism also appears to be be peaking. High profile activist campaigns involve iconic American brands like Hess, Apple and Dell and smaller companies like Herbalife.

shareholder activism also appears to be be peaking. High profile activist campaigns involve iconic American brands like Hess, Apple and Dell and smaller companies like Herbalife.

Media love a good fight, so, when hedge funds come out swinging, the newswires light up. This reality is a double edge sword for hedge funds. On one hand, it is usually easy for the activist to corner a corporate target. Typically, the corporation is a sitting duck for criticism and is predictable in its response. However, the media machine must be fed and sometimes it can bite the activist hand that feeds it juicy, controversial stories.

Recently, hedge funds’ tactics have come into question for distorting the information balance that creates an efficient market for a company’s stock. I’d be curious to see a large sample of how stocks perform after appearing in activists’ crosshairs. Stephen Taub, writing for Institutional Investor’s Alpha looks at some recent examples and concludes that “the so-called smart money set may be able to influence a stock’s performance or direction for a day or two or week. But, over a longer period of time the company’s fundamentals…determine a stock’s direction.”

A potentially more ominous story in the New York Times looks at the actors in the Herbalife contest. “The arrival of the hedge fund billionaires — William A. Ackman, Daniel S. Loeb and Carl C. Icahn — spawned a media circus. And at times, some investors acted as if they were the stars of a reality-TV show,” commented the Deal Professor column. The column goes on to say that after playing their cards, Greenlight Capital and Third Point took their winnings and went home, but Pershing Square and Carl Icahn remain at the table engaged in a high-stakes, heads-up death match over Herbalife. The story suggests that things have gotten personal between the two hedge funds and hints that the apparent stand off is no longer about Herbalife, but about ego.

This could be raising the eyebrows of investors and should be a significant concern to Pershing Square and Icahn. If it begins to appear that either remains involved in Herbalife for any reason other than its investment thesis, it could be extremely damaging. Above all, a hedge fund needs to be perceived as rational and must apply an objective, analytic investment process to its strategy in order to deliver on the “hedge fund promise” (a fund’s ability to use all the arrows in Wall Street’s quiver without taking on significantly more risk than the market as a whole to deliver alpha).

This episode illustrates a fact that most activist hedge funds don’t fully grasp: executing the worlds best media program in connection with a shareholder campaign is not a strategy that builds your reputation. It is a tactic that supports a single investment decision. Think about the New York Yankees. Baseball is simple, right? “Sometimes you win, sometimes you lose, sometime it rains.” But the what the Yankees stand for is far bigger than their record. Activists cannot pin their reputation solely to their record because sometimes you lose and sometimes it rains.

Firms must define the bigger picture, the context in which they operate and use the media to tell that story to LPs, prospective investors and corporations (after all, a fund’s reputation alone can be sufficient to deter corporate resistance). This gives the media a larger narrative with which to work and can define the intricacy and nuance of the hedge fund’s game much more than the scorecard. Funds that don’t look inward to find what makes them tick can find themselves winning many battles, but losing in the larger fight to establish and preserve a reputation around which investors want to congregate.

Corporations invent new poison pills to thwart activists

So far this year, companies have adopted 28 “specific-purpose” poison pills. As if what the markets need are more types of poison pills, corporations (and the law firms that live off the corporate gravy trains) have designed these new pills that are “generally adopted in response to a specific event, such as the public disclosure of a sizable stake by an apparent activist investor, an unsolicited takeover offer or simply after heavy volume of trading in a stock.”

These new pills tend to be stricter than other kinds of poison pills and research shows that specific-purpose poison pills trigger below a 15 percent threshold, significantly lower than what is generally considered to be a shareholder-friendly level of 20%.

Use of this mode of defense appears to be on the rise. FactSet says that in 2006, only 19 of these pills were instituted and and in 2007, 17. Last year, 34 were enacted and, in 2009, when companies were vulnerable due to low stock prices, 56 were triggered.

Last month, Netflix adopted a special-purose plan after Carl Icahn reported at 9.98 percent stake. Netflix took the unusual step of engineering a tw0-tiered threshold. For outside investors, like Mr. Icahn, it is 10 percent. For institutional shareholders who take a passive stake, the limit is 20 percent. It is perhaps a nifty PR move, because “Netflix can argue that it is still looking out for its shareholders beccause it is really taking aim only at those pesky activists.”

At face value, the provision for passive shareholders would limit the ability of an activist to run a campaign to sell the company or change the face of the board. This just at a time when institutional investors — those who Netflix wants to remain passive — are more inclined to join activitsts.

Turns out that the poison pill at Netflix is only the tip of the iceberg of defense mechanisms the company has in place. It also has a staggered board, meaning that anyone wanting to gain effective control of the company “needs a lot of patience and a big war chest to wait out what is at least an 18 month process to ramp up a fight at two such annual meetings.”

While poison pills include provisions that limit the ability of investors to act in conert, these clauses have not been ruled on by a court. As poison pill triggers move lower and lower, this space certainly merits watching, particularly the legal standing of companies’ rights to limit shareholder communication and cooperation.

Further reading: History and background on poison pills, as compiled by The Conference Board.

Breaking news: Netflix’s latest headache is that it is under SEC investigation for possible improper disclosure via a Facebook post by its CEO. Ironic that a company that is perceived to have missed the boat on technology (streaming video) is further undone by a mistep via another technology revolution — social media.