Archive

Proxy power puts asset managers in media spotlight

More than a year ago, an academic paper argued  that the concentration of equity ownership among large fund management companies discouraged competition.

that the concentration of equity ownership among large fund management companies discouraged competition.

The Azar-Schmalz study suggested that since mutual funds and ETFs own more than one company in a sector, they are harmed by price wars which might reduce profitability across the sector and pricing for consumers is artificially high as a result. The study looked to the airline industry for evidence.

The theory is interesting but far fetched. First, air travel is a heavily regulated sector and regulation has many market-skewing effects. Also, with dramatic consolidation among US airlines, there are more obvious reasons for why fares might appear homogeneous. More fundamentally, however, a direct correlation between cross ownership and pricing trends would demand an unfathomable and unsustainable degree of coordination between boardrooms and fund companies.

Nonetheless, credence is growing among media. Matt Levine, author of the influential Money Stuff daily email from Bloomberg View, began as a skeptical admirer of the novelty of theory, but has referenced it regularly for several months. In a recent piece, he writes, “What I like about the mutual-funds-as-antitrust-violation theory is that it is both crazy in its implications — that diversification, the cornerstone of modern investing theory and of most of our retirement planning, is (or should be) illegal — and totally conventional in its premises.”

Professor Schmalz is author of a new paper, “Common Ownership, Competition and Top Management Incentives” which expands the theory and links cross ownership to the prevalence of ultra high executive compensation. Levine explains, “But ‘say-on-pay’ rules mean that shareholders get at least some formal approval rights over compensation, and I guess the boards and consultants and managers have to design pay packages that will appeal to investors. And if those investors are mostly diversified, then they won’t have much demand for pay packages that encourage one of their companies to crush another.”

Executive compensation is a major corporate governance issue and an area where large shareholders do have a lever over corporate policy. A year ago, this blog noted that hedge funds are uncharacteristically quiet on the topic of exec pay. I also uncovered that the companies paying their CEOs the most are very likely to also be the most shorted. However, despite pervasive questions on how to best structure executive compensation plans, the 10 largest asset managers supported the pay plans at about 95% of the S&P 500 companies. And yet, new research shows that looking at return on corporate capital, 70% the top 200 US companies overpay their CEOs, relative to sector and revenue size.

Furthermore, Wintergreen Advisers notes that there are hidden costs to high pay. First, stock grants to executives dilutes existing shareholders. Second, companies often initiate stock buybacks to offset that dilutive effect on other stockholders’ stakes (and we all know most buybacks are not good for shareholders). “We realized that dilution was systemic in the Standard & Poor’s 500,” Mr. Winters tells the New York Times, “and that buybacks were being used not necessarily to benefit the shareholder but to offset the dilution from executive compensation. We call it a look-through cost that companies charge to their shareholders. It is an expense that is effectively hidden.”

The issues of competition and compensation illustrate how central asset managers have become in the discussion about how corporations operate. The media increasingly identify stock ownership with direct influence (perhaps due to how successful activist investors have been in recent years) and the media are ready to lay a raft of corporate ills at the feet of those with the most votes. It logically starts with executive compensation, but it could quickly extend into other corporate practices such as employee compensation, retirement policy, health benefits — issues which most asset managers would view as outside their sphere of influence. With the role of government and the social safety net shrinking, society looks to corporations to step into the breach. The challenge for large asset managers is that the media and perhaps others expect them to be the defacto regulators of the corporations.

Rift widens between mutual funds and activists

The largest asset managers, led by BlackRock, are  elbowing activists out of the spotlight on the topic of corporate governance. This blog has tracked tracked how mutual funds are putting distance between their priorities and the activist agenda (see here, here, here, here and here). The rift widened earlier this month when BlackRock, Fidelity, Vanguard and T. Rowe Price met with Warren Buffet and JPMorgan to create guidelines for best practice on corporate governance. Discussions have focused on issues such as the role of board directors, executive compensation, board tenure and shareholder rights, all of which have been flashpoints at US annual meetings.

elbowing activists out of the spotlight on the topic of corporate governance. This blog has tracked tracked how mutual funds are putting distance between their priorities and the activist agenda (see here, here, here, here and here). The rift widened earlier this month when BlackRock, Fidelity, Vanguard and T. Rowe Price met with Warren Buffet and JPMorgan to create guidelines for best practice on corporate governance. Discussions have focused on issues such as the role of board directors, executive compensation, board tenure and shareholder rights, all of which have been flashpoints at US annual meetings.

This effort appears to be in direct response to the prominence of activist hedge funds (now managing in excess of $100 billion) and the success they have had in forcing share buybacks and other financial moves by corporations to increase returns to shareholders.

On the heels of the meeting, BlackRock CEO Larry Fink sent another letter to chief executives of S&P 500 companies urging “resistance to the powerful forces of short-termism afflicting corporate behavior” and advocating they invest in long-term growth. Make no mistake, “short-termism” is code for activist hedge funds and paragraph two of the letter takes aim at common goals of activists:

Dividends paid out by S&P 500 companies in 2015 amounted to the highest proportion of their earnings since 2009. As of the end of the third quarter of 2015, buybacks were up 27% over 12 months. We certainly support returning excess cash to shareholders, but not at the expense of value-creating investment. We continue to urge companies to adopt balanced capital plans, appropriate for their respective industries, that support strategies for long-term growth.

The letter asks CEOs to develop and articulate long term growth plans and move away from quarterly earnings guidance. “Today’s culture of quarterly earnings hysteria is totally contrary to the long-term approach we need,” writes Fink. Without a long term plan and engagement with investors about the plan, “companies also expose themselves to the pressures of investors focused on maximizing near-term profit at the expense of long-term value. Indeed, some short-term investors (and analysts) offer more compelling visions for companies than the companies themselves, allowing these perspectives to fill the void and build support for potentially destabilizing actions.”

With respect to “potentially destabilizing actions,” Fink acknowledged that BlackRock voted with activists in 39% of the 18 largest U.S. proxy contests last year, but says “companies are usually better served when ideas for value creation are part of an overall framework developed and driven by the company, rather than forced upon them in a proxy fight.”

With this letter and the group of large investors that is in formation, traditional fund managers are giving corporate America a buffer against activists. If a company were to explain to the largest asset managers “how the company is navigating the competitive landscape, how it is innovating, how it is adapting to technological disruption or geopolitical events, where it is investing and how it is developing its talent,” and had their support, it would be more straightforward to resist an activist campaign, particularly one based on a financial strategy like buybacks. “Companies with their own clearly articulated plans for the future might take away the opportunity for activists to define it for them,” writes Matt Levine in Bloomberg View.

If the pendulum is to shift from activists to traditional fund managers, are they ready to be proactive on governance matters? The AFL-CIO’s key vote survey which tracks institutional voting on proposals to split the roles of chairman and CEO, curb executive compensation, give shareholders more say in board appointments and improve disclosures about lobbying, found many of the largest mutual/index fund companies to be in the bottom tier of firms in their support for these governance-related votes.

The FT suggests that the size of these institutions may limit their involvement, “any governance principles that emerge from a consensus of the large managers are likely to fall short of those typically supported by the powerful proxy advisory services ISS and Glass Lewis, which offer voting recommendations to pension funds and other investors.”

However, a research paper entitled Passive Investors, Not Passive Owners finds that ownership by passively managed mutual funds is associated with significant governance changes such as more independent directors on corporate boards, removal of takeover defenses and more equal voting rights.

Investing for the long term is an issue in the Presidential campaign and is becoming more relevant in corporate America as the US adjusts to globalization, technology that is disrupting many sectors and the continuing shift from manufacturing to service and knowledge-based industries. The practice of quarterly reporting limits disclosure and discourse about long term objectives. As Matt Levine notes, “If you are an investor, you might want to know your company’s plans, no? It is odd that corporate disclosure is so backward-looking; like so much in corporate life, it is probably due mostly to the fear of litigation…Also, notice that Fink’s list of “what investors and all stakeholders truly need” is exactly what isn’t (for the most part) in companies’ public disclosures.”

In the UK, quarterly earnings reports are optional and more companies are giving them up. “I am surprised that more people haven’t stopped,” Mr Lis [of Aviva Investors] says. “For long-term investors it really wouldn’t matter whether there are quarterly reports or not in any sector.”

The investor group and the BlackRock letter are more examples of fund managers pursuing a governance agenda independent of activists. It remains to be seen how wide the rift between index/mutual fund managers and activist hedge funds will become, but it is clear that some major asset managers have seen limitations in today’s forms of activist investing, been put off by regular overreach by activists and maybe concluded that activists have jumped the shark.

Carl Icahn is right….again

The “debate” between Carl Icahn and Larry Fink at the Delivering  Alpha conference last July stirred up the media, but was not not the best theatre, in part because Carl Icahn hijacked the discussion with a rambling, disjointed critique of bond ETFs. You can view the exchange here.

Alpha conference last July stirred up the media, but was not not the best theatre, in part because Carl Icahn hijacked the discussion with a rambling, disjointed critique of bond ETFs. You can view the exchange here.

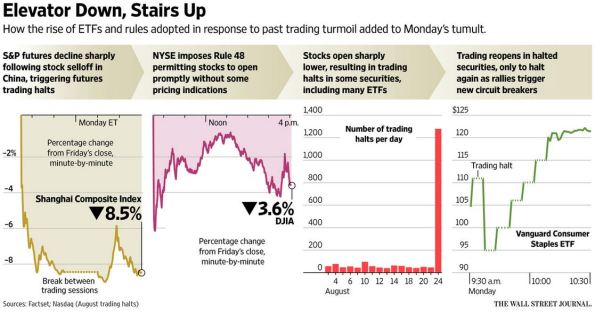

What a difference a couple of weeks make. The China-induced market crash not only exposed liquidity and pricing challenges in ETFs presaged by Icahn, but also that the risk extends to vanilla equity ETFs.

The Wall Street Journal reports about price drops in ETFs that exceeded the declines in prices of the underlying holdings and halts in trading among large ETFs, resulting in “outsize losses for investors who entered sell orders at the depth of the panic.” In a similar examination of a disconnect between investor expectations and market function, Reuters writes that certain mutual funds focused on syndicated loans are opting to hold more cash to prepare for redemptions in a market where liquidity and trade settlement risk are well known to insiders.

So it turns out that Mr. Icahn was right (again). Icahn is unique among activists because he addresses the marketplace issues that affect all investors. Corporate governance is a mainstay of the Icahn platform and at Delivering Alpha, he shows us that market structure, product suitability and risk disclosures are equally important. Hedge funds need to join the debate on these issues.

At a time when the reputation of hedge funds, especially activists, is at a tipping point, managers should be increasingly vocal on topics that trigger automatic support from the media, regulators and the public: fair play in the markets, transparency and misrepresented risks, and even HFT.

The golden age of shareholder activism

We are in the golden age of hedge fund  shareholder activism and the evidence is everywhere

shareholder activism and the evidence is everywhere

- T. Rowe Price voted with dissident shareholders 52% of the time in in board contests between 2009 and 2013. Fidelity voted with dissidents 44% of the time.

- Institutional Investor reports that from January through September last year, hedge funds were “somewhat victorious” in 19 of 24 proxy contests they initiated.

- The Shareholder Rights Project at Harvard Law School, in just one proxy season, succeeded in getting about a third of all the S.&P. 500 companies that had a staggered board to eliminate it.

- Even PR firms, law firms and the legendary Martin Lipton (inventor of the poison pill) whose bread is buttered by corporations acknowledge that it is getting harder to fight activists.

Will activist hedge funds seize the day or will they squander this opportunity to transform  corporate governance and how the market holds boards and management accountable for poor performance?

corporate governance and how the market holds boards and management accountable for poor performance?

Corporate defenders like Mr. Lipton are trying to frame the debate around the issue of long term value. Hedge funds, they argue, are short term opportunists that interfere with corporations’ ability to manage for the long term.

This week Larry Fink, CEO of BlackRock, sent a letter to CEO of every S&P 500 company advocating for greater focus on creating long term value. While the letter doesn’t specifically reference activist hedge funds, it does call into question why companies raise dividends and buy back shares — some of the low hanging fruit that a company use to placate an activist. BlackRock, though, is working all angles. It also is a member of the recently formed Shareholder-Director Exchange which aims to formalize how corporations engage with institutional shareholders. (The Conference Board also has developed a set of principles to increase public trust in big business.) Yet, despite these efforts to work within the system, BlackRock voted with dissident shareholders 34% of the time last year.

There is a real issue tied to short vs long-termism. The ratio of corporate cash to capex is almost at all time low (click to see chart), raising the important question of whether corporations are investing enough to be competitive in the future. It appears disingenuous, though, to suggest that activism is the cause.

If defenders of the status quo are really concerned with long term growth and corporations delivering on long term strategy, they should be as vocal about the myriad of other factors that work contrary to those principles. Take the issue of quarterly earnings guidance. Most companies still provide earnings guidance and presumably manage based on that guidance. I would argue that is a greater short term pressure on corporate America than any group of hedge funds.

In order to capitalize on the tailwinds that are helping activists, they must realize that their reputation is the most powerful weapon in their arsenal. Funds that strike an effective balance between quiet advocacy and calibrated confrontation with boards, establish working relationships with pension funds, and become viewed as positive agents for change by the media, proxy advisory firms and others in the corporate governance arena will be the ones who translate the golden age of activism into riches for their LPs.

Week in Review

Et tu, mutual funds? Smart Money writes about the sorry state of most mutual fund boards of directors. Some stats: 15% of mutual fund directors have served for more than 20 years; the average pay is $260,000 for attending between four and 8 meetings per year; and one enterprising director oversees 170 funds and pulls in $1 million per year. “Being on a mutual fund board is the most comfortable position in corporate America,” says Arthur Levitt, a former SEC chairman.

Shareholder value: Not! In a new book, Cornell Professor Lynn Stout argues that shareholder value is the wrong metric on which to focus in order to create long term profits. Dealbook outlines her argument that “as companies have increasingly focused on their stock prices and given managers more shareholdings, they have inadvertently empowered hedge funds that push for short-term solutions.” On the other side of the debate: Milton Friedman and Nell Minow.

Investors say nay on exec pay. Deal Journal notes that a record 80% of votes cast by shareholders of Chesapeake Energy were against the pay package slated for CEO Aubrey McClendon. With 55% of votes cast going against Citi chief Vikram Pandit’s comp, this is a trend to watch.

Star-studded hedge funds don’t aim for the sequel. Institutional Investor writes that as a generation of extremely successful hedge fund managers near retirement age, few appear to be ready to effectively hand over the Bloomberg terminal and take the steps needed for their firms to endure. “Many managers are not taking the succession process seriously enough or are not willing to face up to what it entails…Some industry experts, including a few longtime managers, believe some managers talk about succession solely to retain employees and clients, even though they have no plan to keep their firms running after they retire.”

Sleeping giants of the buy side are powerful partners for activists

Are mutual funds and other buy-side institutions getting into the activist game? The Dealbook blog at NYTimes.com writes that “increasingly it is mutualfunds and other more tempered institutional shareholders who are criticizing lavish pay packages and questioning corporate governance.” According to the article, traditional money managers are not typically the vocal, public face of activist campaign, but behind the scenes, they are the hand that wields the sword that brings boards and management to the negotiating table.

For example, the article suggests that in the case of Canadian Pacific Railway, it wasn’t the campaign launched by Pershing Square, but rather the involvement of a large Canadian pension fund that led to the resignation of the CEO. Charles Elson of the University of Delaware comments, “Years ago, it was really just the large pension funds and labor funds,” he said. “Today you’re seeing a very wide mix of people.” ISS predicts a spike in proxy fights this year.

This trend looks powerful and alliances between hedge funds and real-money managers could be the blueprint needed to more successfully and consistently win proxy fights. Looking down the road, activist hedge funds will more proactively recruit “quiet” but influential partners like mutual funds to join their causes. It won’t be easy. Traditional money managers are still risk averse and they will want to back a winner, because failing in a public campaign brings risks of its own. To create the coalitions within the buy-side, activist hedge funds need to act carefully in order not to alienate traditional firms.

The successful activists will create their own “brand” of activism and an identity based on a track record of finding remedies for specific types of governance or performance issues. It will be easier for pension funds and others to align with those “branded” hedge funds.

Are the sleeping giants of the buy side waking up to activists? Probably, but not just any activist will get their support.